Welcome to our article exploring the benefits of ERP financial software for your business! In today’s fast-paced and competitive business world, having the right tools to manage your company’s finances is crucial for success. ERP financial software offers a wide range of benefits, from streamlining processes to improving decision-making and increasing efficiency. By implementing ERP financial software, you can take your business to the next level and achieve greater success.

Benefits of ERP Financial Software

ERP (Enterprise Resource Planning) financial software is an essential tool for businesses looking to streamline their financial processes and improve overall efficiency. The benefits of using ERP financial software are numerous and can greatly impact the success of a company.

One of the key benefits of ERP financial software is the ability to automate and integrate financial processes. This means that tasks such as invoicing, payroll, and budgeting can all be managed within one system, eliminating the need for manual data entry and reducing the risk of errors. By automating these processes, businesses can save time and resources, allowing employees to focus on more strategic tasks.

Another benefit of ERP financial software is the improved accuracy and reliability of financial data. With all financial information stored in one system, there is less chance of discrepancies or inconsistencies in the data. This not only helps with compliance and reporting requirements but also provides decision-makers with up-to-date and accurate information to make informed choices.

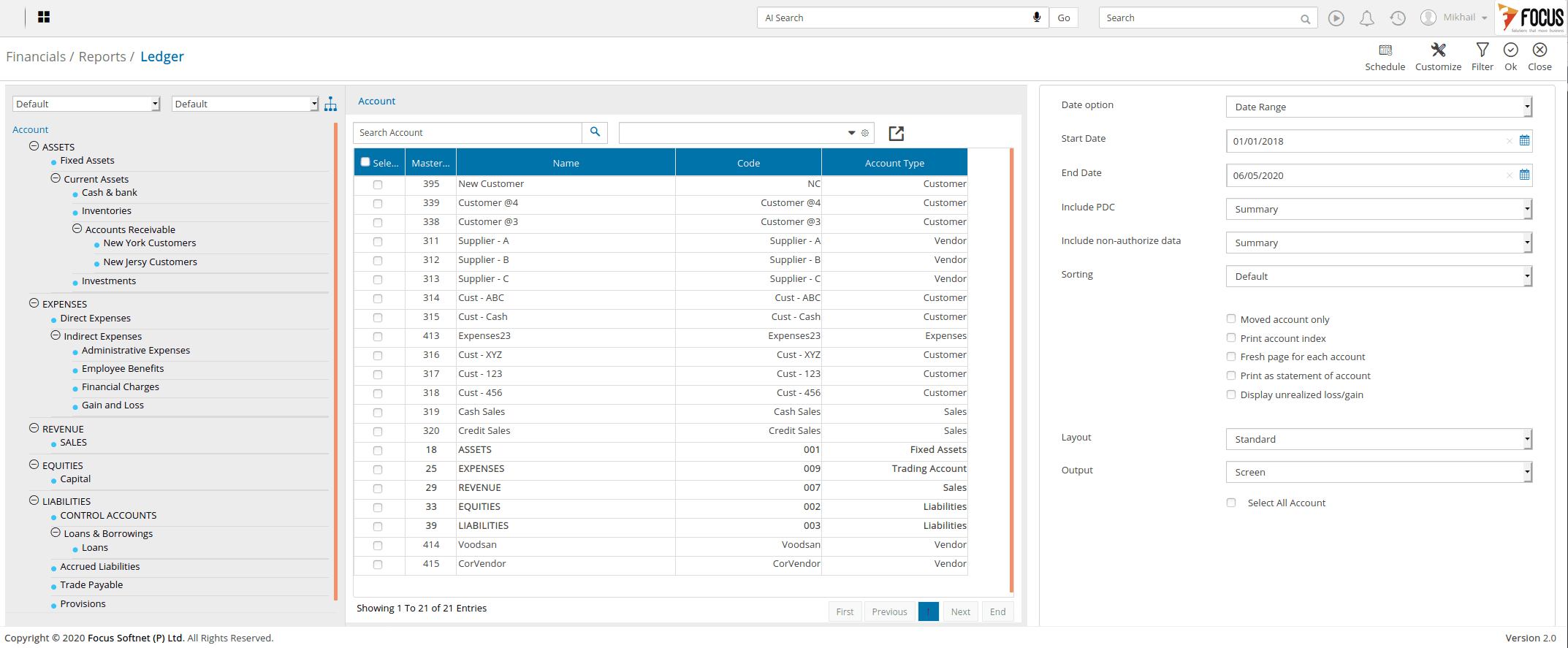

One of the main advantages of ERP financial software is the increased visibility it provides into the financial health of a business. With real-time reporting and analytics, businesses can easily track key performance indicators, identify trends, and make data-driven decisions. This level of visibility allows businesses to proactively address any issues that may arise and take advantage of opportunities for growth.

ERP financial software also promotes collaboration and communication within an organization. With all financial data accessible to relevant departments, employees can work together more effectively and make informed decisions based on accurate information. This level of collaboration can lead to improved productivity and efficiency across the organization.

Furthermore, ERP financial software can help businesses reduce costs and increase profitability. By streamlining processes and improving efficiency, businesses can save money on administrative tasks and reduce the risk of financial errors. Additionally, the data provided by ERP financial software can help businesses identify areas where costs can be cut or where revenue can be increased, leading to improved financial performance.

In conclusion, the benefits of ERP financial software are extensive and can have a significant impact on the success of a business. From streamlining processes and improving accuracy to increasing visibility and promoting collaboration, ERP financial software is a valuable tool for any organization looking to improve their financial management practices.

Implementation of ERP Financial Software

When it comes to implementing ERP financial software, there are several key steps that need to be taken in order to ensure a successful transition. The first step is to conduct a thorough assessment of your current financial processes and systems. This will help identify areas of improvement and determine the specific needs and requirements of your organization.

Once you have a clear understanding of your current financial landscape, the next step is to choose the right ERP financial software solution for your business. It’s important to consider factors such as the size and complexity of your organization, your budget, the level of customization required, and the scalability of the software.

After selecting the appropriate ERP financial software, the next step is to develop an implementation plan. This plan should outline the various stages of the implementation process, assign responsibilities to specific team members, and establish a timeline for completion. It’s crucial to involve key stakeholders from different departments in the planning process to ensure that all aspects of your business are taken into consideration.

One of the most important aspects of implementing ERP financial software is training. It’s essential to provide comprehensive training to all employees who will be using the software, including finance, accounting, and other relevant staff members. This will help ensure a smooth transition and minimize disruptions to daily operations.

During the implementation phase, it’s important to regularly monitor progress and address any issues or challenges that arise. This may involve making adjustments to the implementation plan, providing additional training, or seeking assistance from the software provider or implementation partner. Communication is key during this phase to ensure that everyone is on the same page and that any issues are addressed promptly.

Once the ERP financial software is fully implemented, it’s important to conduct a thorough evaluation to assess the effectiveness of the new system. This may involve analyzing key performance indicators, gathering feedback from users, and identifying areas for further improvement. Continuous monitoring and evaluation are essential to ensure that the software is meeting your organization’s needs and providing the expected benefits.

In conclusion, implementing ERP financial software requires careful planning, thorough assessment, effective training, and ongoing evaluation. By following these steps and involving key stakeholders throughout the process, you can help ensure a successful transition to a new financial system that will help streamline processes, improve efficiency, and support the growth of your organization.

Features to Look for in ERP Financial Software

When considering ERP financial software for your business, it is crucial to look for specific features that will help you manage your finances more efficiently. Here are some key features to look for in ERP financial software:

1. Integration with other systems: One of the most important features to look for in ERP financial software is its ability to integrate seamlessly with other systems in your organization. This includes integration with your HR systems, inventory management systems, and customer relationship management systems. This integration ensures that all of your financial data is up-to-date and accurate across all aspects of your business.

2. Customizable reporting tools: Another important feature to look for in ERP financial software is customizable reporting tools. These tools allow you to generate detailed financial reports that are tailored to your specific business needs. Whether you need to track expenses, analyze revenue, or monitor cash flow, customizable reporting tools make it easy to access the information you need to make informed financial decisions.

3. Advanced security features: In today’s digital age, data security is more important than ever. When choosing ERP financial software, it is essential to look for advanced security features that protect your sensitive financial data from unauthorized access. Look for software that offers encryption, user authentication, and role-based access controls to ensure that only authorized users can access your financial information. Additionally, consider software that offers regular security updates and monitoring to stay ahead of potential security threats.

Cost considerations for ERP Financial Software

When it comes to implementing ERP Financial Software, one of the most crucial factors to consider is the cost involved. Before making any decisions, it is important to thoroughly analyze the financial implications of investing in such a system.

1. Initial Cost: The initial cost of ERP Financial Software can vary greatly depending on the vendor, the complexity of the system, and the specific needs of your company. It is essential to carefully evaluate your budget and determine how much you are willing to invest in this software. Some vendors offer flexible pricing options, such as monthly subscriptions or pay-per-user models, which can help you manage your expenses more effectively.

2. Implementation Cost: In addition to the initial cost of the software itself, you will also need to consider the cost of implementing it within your organization. This may include expenses related to training employees, configuring the system to meet your specific requirements, and integrating it with existing systems. It is important to budget for these additional costs to avoid any unexpected financial burdens down the line.

3. Maintenance and Support Cost: Once the ERP Financial Software is up and running, you will need to budget for ongoing maintenance and support. This may include fees for software updates, technical support services, and system upgrades. It is important to understand the terms of the vendor’s maintenance agreement and factor these costs into your budget to ensure the long-term viability of the system.

4. Customization Cost: One important cost consideration that often gets overlooked is the cost of customizing the ERP Financial Software to meet your company’s specific needs. While many software packages come with a range of standard features and functionalities, you may find that certain aspects need to be tailored to align with your unique business processes. This customization can be a significant expense, so it is essential to discuss these requirements with the vendor upfront and obtain a detailed cost estimate before proceeding.

In conclusion, investing in ERP Financial Software can provide numerous benefits for your organization, but it is essential to carefully consider the costs involved. By evaluating the initial cost, implementation cost, maintenance and support cost, and customization cost, you can make informed decisions that align with your budget and strategic objectives. Remember to conduct thorough research, negotiate with vendors, and develop a comprehensive cost management plan to ensure a successful ERP implementation process.

Integration of ERP Financial Software with other systems

One of the key advantages of using ERP financial software is its ability to integrate with other systems, allowing for seamless data flow and communication between different departments within an organization. By integrating ERP financial software with other systems, businesses can streamline their processes, improve efficiency, and make better-informed decisions based on real-time data.

ERP financial software can be integrated with various systems, such as CRM (Customer Relationship Management), HR (Human Resources), SCM (Supply Chain Management), and BI (Business Intelligence) systems. This integration allows for better communication and coordination between different departments, leading to a more cohesive and efficient organization as a whole.

For example, by integrating ERP financial software with a CRM system, sales and finance teams can have access to the same customer data, allowing for better collaboration and coordination when it comes to invoicing, payments, and customer support. This integration can also help businesses track customer interactions, preferences, and purchases, leading to more personalized marketing and sales efforts.

Integrating ERP financial software with HR systems can also be beneficial, as it allows for better management of employee data, payroll, benefits, and performance evaluations. This integration can help businesses ensure compliance with labor laws, streamline the onboarding process, and provide employees with self-service tools for managing their information.

SCM integration with ERP financial software can help businesses optimize their supply chain operations, track inventory levels, and manage vendor relationships more efficiently. By having access to real-time data on supply chain activities, businesses can reduce costs, minimize stockouts, and improve overall customer satisfaction.

Lastly, integrating ERP financial software with BI systems can provide businesses with valuable insights and analytics to drive decision-making. By combining financial data with operational data, businesses can gain a better understanding of their performance, identify trends, and forecast future outcomes more accurately.

In conclusion, integrating ERP financial software with other systems is essential for maximizing the benefits of such software and enabling organizations to operate more efficiently, make better decisions, and stay competitive in today’s fast-paced business environment. Businesses that leverage the power of integration are better equipped to adapt to change, innovate their processes, and ultimately achieve their strategic goals.

Originally posted 2025-01-18 19:37:03.